Value investing, a time-honored strategy pioneered by renowned investors like Benjamin Graham and Warren Buffett, continues to be a cornerstone of successful investing. At its core, value investing revolves around the principle of purchasing assets that are trading at a discount to their intrinsic value. This approach contrasts with the more speculative nature of growth investing, as value investors prioritize the underlying fundamentals of a company rather than its potential for rapid growth.

Understanding the Basics of Value Investing

To understand value investing, one must first grasp the concept of intrinsic value. Intrinsic value represents the true worth of a company based on its fundamental characteristics, such as earnings, assets, and growth potential. Value investors believe that over time, the market will recognize and reflect a company’s intrinsic value, leading to an increase in its stock price.

Key Principles of Value Investing

Value investing is guided by several key principles, including patience, discipline, and a focus on long-term value creation. Unlike traders who may seek quick profits from short-term market fluctuations, value investors take a more strategic approach, often holding onto their investments for years or even decades. They conduct thorough research to identify undervalued opportunities and have the conviction to stick with their investments through market downturns.

Identifying Undervalued Stocks

Value investors employ various metrics and techniques to identify undervalued stocks. One commonly used metric is the price-to-earnings (P/E) ratio, which compares a company’s stock price to its earnings per share. A low P/E ratio relative to industry peers may indicate that a stock is undervalued. Similarly, the price-to-book (P/B) ratio, which compares a company’s stock price to its book value per share, can also provide insights into a stock’s valuation.

The Importance of Margin of Safety in Value Investing

Central to the philosophy of value investing is the concept of margin of safety. This refers to the difference between the intrinsic value of a stock and its market price. By purchasing stocks with a significant margin of safety, investors can protect themselves against unforeseen events or market

downturns. This conservative approach reduces the risk of permanent capital loss and provides a buffer for potential fluctuations in the market.

Contrarian Investing and Market Psychology

Value investors often adopt a contrarian mindset, which means they are willing to go against the crowd and invest in stocks that are unpopular or out of favor. This approach requires courage and conviction, as it may involve buying stocks when others are selling due to fear or uncertainty. By

capitalizing on market inefficiencies and mispricing, contrarian investors can uncover valuable opportunities that others may overlook.

Analyzing Financial Statements

Value investing involves meticulous analysis of a company’s financial statements—balance sheet, income statement, and cash flow statement. Key metrics like return on equity (ROE), debt-to-equity ratio, and free cash flow are scrutinized to assess profitability, leverage, and cash generation.

This scrutiny informs investment decisions aligned with long-term goals and risk tolerance.

Example: Apple Inc.

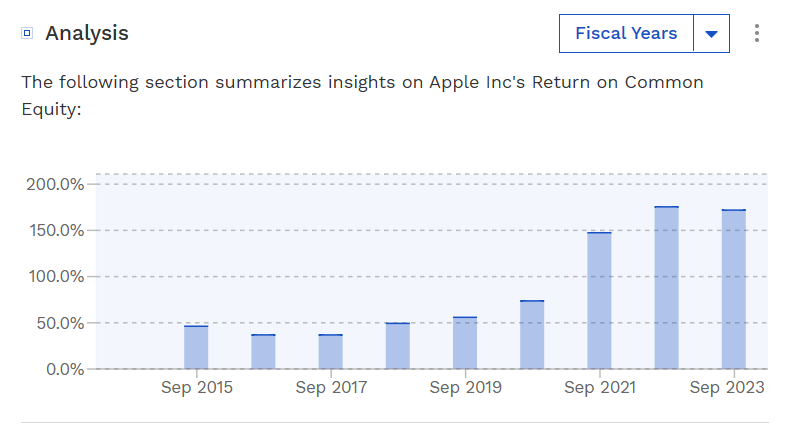

Apple Inc. has consistently shown robust performance in return on common equity (ROE). Over the past twelve months, Apple achieved an impressive ROE of 154.3%, demonstrating its ability to generate significant returns for shareholders. On average, from fiscal years ending September 2019 to 2023, Apple maintained a strong ROE of 124.9%. Despite fluctuations, with its ROE peaking at 175.5% in September 2022 and hitting its lowest at 55.9% in September 2019, Apple has demonstrated overall positive trends in ROE. Notably, while there was a slight decrease in ROE in 2023 (171.9%), the company saw significant increases in ROE in previous years, reflecting its dynamic performance in response to market conditions and strategic initiatives.

Conclusion

In conclusion, value investing offers a time-tested framework for identifying undervalued stocks in the market. By focusing on intrinsic value, maintaining a margin of safety, and adopting a contrarian mindset, investors can position themselves for long-term success. While value investing requires patience, discipline, and a thorough understanding of fundamental analysis, the potential rewards in terms of capital appreciation and wealth accumulation can be substantial.

Sources:

Return on Common Equity For Apple Inc (AAPL) (finbox.com)

A Breakdown Of Apple’s ROE Tells A Cautionary Tale (NASDAQ:AAPL) | Seeking

Alpha

Ratios Can Tell If a Stock Is Overvalued or Undervalued (investopedia.com)

How to Spot an Undervalued Stock (yahoo.com)

Mastering the Art of Value Investing: A Comprehensive Guide for Long-term Wealth Creation Samir H Bhatt