Disney’s Unique Ecosystem

Investing in Disney stock means diving into a unique ecosystem where content, theme parks, and merchandise converge. With iconic characters like Mickey Mouse and Star Wars, Disney boasts a rich legacy that continues to resonate with audiences worldwide.

Streaming Dominance

One of Disney’s compelling arguments for long-term investment is its streaming dominance. Disney+ has swiftly become a powerhouse in the streaming world. Amassing millions of subscribers in a short span. With a vast content library and a growing presence in international markets, Disney’s streaming services provide a solid foundation for future growth. Besides Disney +, the company owns ESPN + and partially also the streaming platform HULU.

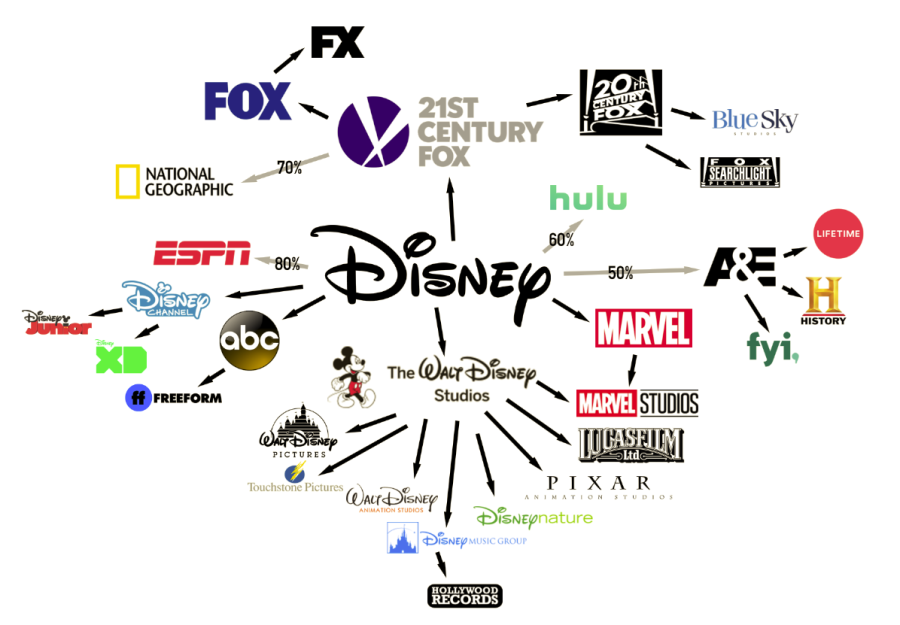

Content Creation Powerhouse

Disney’s content creation prowess cannot be overstated. This is because it’s not just about movies and TV shows. Disney owns franchises like Marvel, Pixar, and National Geographic, delivering a diverse range of entertainment. This content creation machine ensures a continuous stream of hits that captivate audiences across the globe.

The company’s commitment to creating new content is evident in its extensive slate of upcoming films and TV shows, promising a continuous stream of hits.

In the article from CNBC Disney’s CEO, Bob Iger, emphasized plans to improve the quality of studio films and reduce the number of released titles and associated costs. Tiger also hinted that Disney’s TV networks, excluding ESPN, may no longer be considered core to the business. Separately, Disney is looking to take full control of Hulu, a move expected to cost at least $9 billion.

Diversified Revenue Streams

A crucial point in favor of Disney stock is its diversified revenue streams. Beyond the entertainment division, Disney also owns ESPN, a sports giant. This diversity helps mitigate the risks associated with any single sector. Despite the challenges posed by the pandemic to theme parks and film production, Disney’s diverse portfolio has enabled the company to remain resilient.

Post-Pandemic Recovery

As the pandemic wanes, Disney’s theme parks are gradually reopening, indicating a promising post-pandemic recovery. Disney’s Parks, Experiences, and Products division showed strength with a 13% increase in revenue to $8.3 billion, driven by international parks’ success.

However, domestic parks, especially Walt Disney World in Florida, experienced a slowdown in attendance and hotel room purchases. Yet Disney is not resting on its laurels. In fact, the company plans to invest heavily in its theme parks to enhance the visitor experience and introduce new attractions. This way, it will ensure long-term growth in this segment.

Brand Recognition and Loyalty

Disney’s unparalleled brand recognition and customer loyalty contribute significantly to its long-term investment appeal.

The emotional connection many consumers have with Disney’s characters and stories creates a substantial moat that protects the company from competition.

Mergers and Acquisitions

Disney’s acquisition of 21st Century Fox and its solidification as a Hollywood powerhouse is another compelling argument. This move expanded Disney’s already extensive portfolio, further enhancing its competitive position. What’s more, Disney has expressed its intention to continue seeking strategic acquisitions that align with its long-term growth objectives.

Innovation and Technology

Disney’s dedication to innovation and technology ensures it remains at the forefront of the industry. The company continually invests in new technology to enhance the consumer experience and stay ahead of the competition.

Challenges and Risks

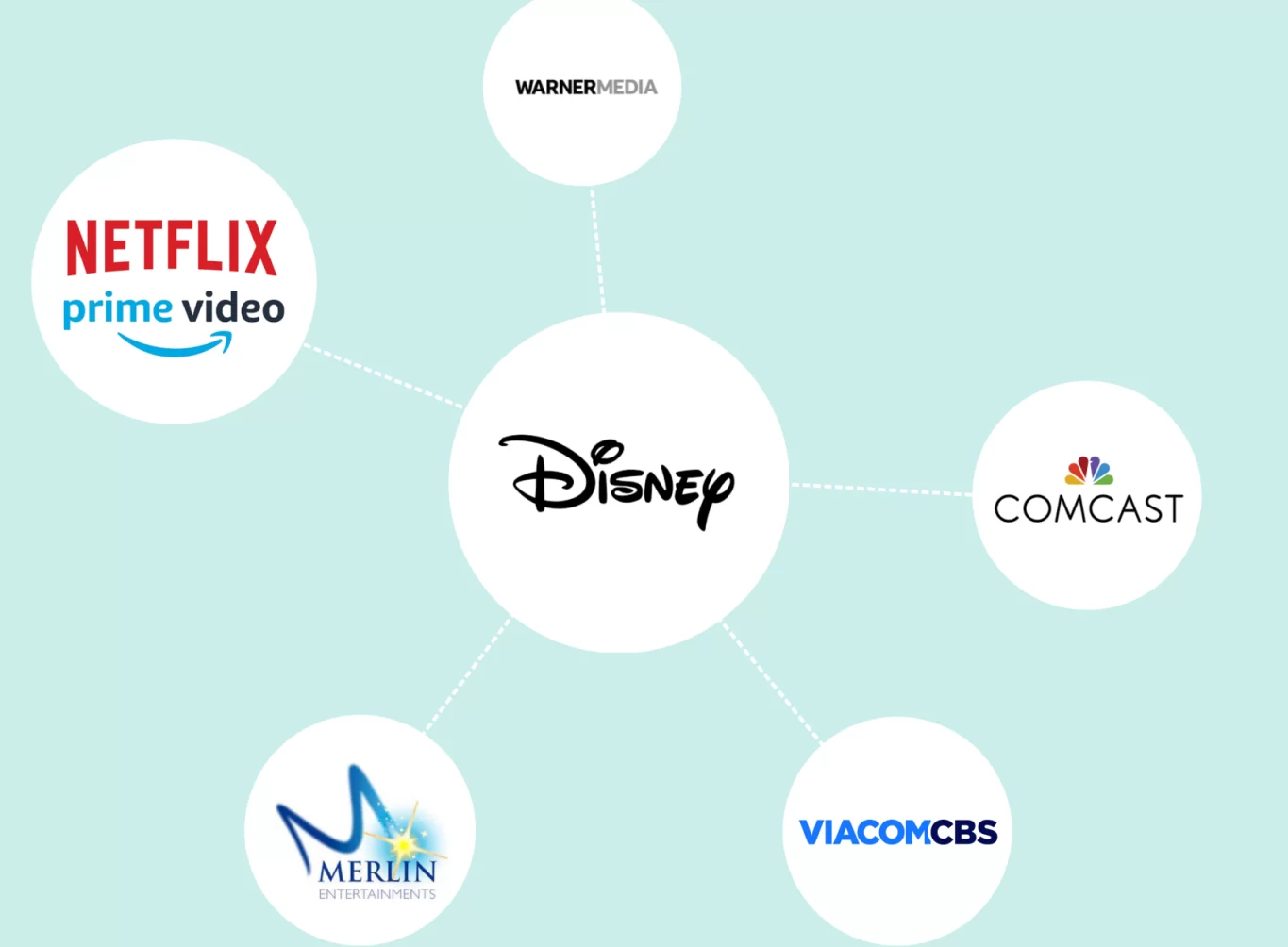

While Disney presents a robust investment case, it’s vital to acknowledge potential challenges and risks. Content production costs can be substantial, and the ever-evolving entertainment landscape requires constant adaptation.

Competition is fierce, with major players like Netflix and Amazon continuously striving for a piece of the market. Disney is aware of these challenges and is actively addressing them through its investments in content quality and technology.

Why invest in Disney?

In conclusion, Disney stock offers a persuasive argument for long-term investors. The company’s diverse revenue streams, streaming dominance, content creation prowess, and brand recognition make it a highly attractive investment choice. As Disney’s theme parks are recovering from the pandemic. The company is also investing in new technology and content, making it a compelling addition to a long-term investment portfolio.