Trading psychology involves studying and understanding how mental and emotional factors influence traders’ behavior, decision-making, and success in finance. It analyzes how biases in cognition, discipline, and mental states affect trading outcomes. It recognizes that traders are influenced by various psychological elements, leading to biased thinking, impulsive behavior, and suboptimal decision-making.

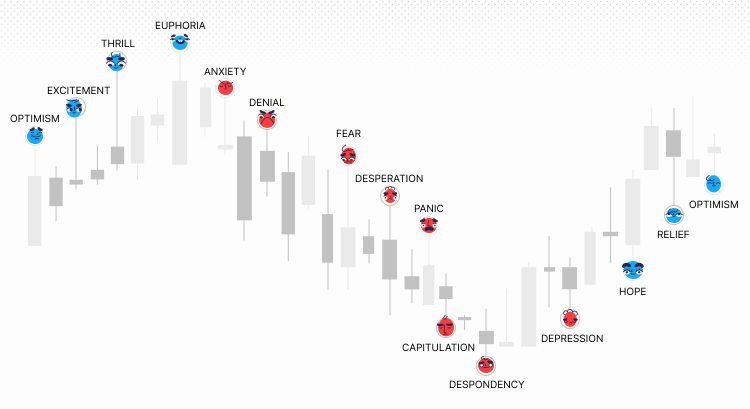

Although a person’s emotional range might be wide and complex, traders usually identify 14 essential trading emotions. These typically occur in waves, starting with elation and enthusiasm and ending with despair and melancholy.

This post may contain affiliate links, which means I may receive a small commission, at no cost to you, if you make a purchase through a link.

How emotions impact the trading decisions you make

Cognitive biases: Insecurity and excessive risk-taking, or, conversely, fear of losing and giving up on trading, are only a few of the cognitive biases that emotional trading may cause.

Making snap decisions: Making snap decisions can lead to expensive errors, a lack of control, and supervision, which could expose traders to higher losses.

Loss aversion: This mentality can lead traders to focus only on their immediate losses and steer clear of the market.

Techniques for emotional management

Emotional intelligence is an essential competency for cryptocurrency traders. The following strategies can assist you in controlling your emotions and making sure that strategy, not emotion, guides your decisions:

Keep a trading journal: Recording all of your trades, along with the reasons for them, the results, and your emotions at the time, can be quite illuminating. By going through this notebook, you’ll be able to recognize emotional trends and triggers, which can help you draw lessons from the past and make more thoughtful judgments going forward.

Establish definite objectives: Establish your goals for your trading, whether they be to accumulate wealth over the long term or to bring in a specific quantity of money. Setting and achieving specific goals might help you maintain focus and avoid making rash judgments.

Make a strategy for trading: Your trading methods, risk tolerance, and conditions for entering and leaving trades are all outlined in a clear and concise trading strategy.

Adhere to your plan: Once you’ve made a plan, follow it through. Although it’s simple to be influenced by market hysteria or panic, going off course during these periods frequently results in bad choices.

Making Decisions in Trading

Making the correct choices can make the distinction among success and failure when trading. It’s not simple to navigate the intricate world of financial markets, though. Traders frequently have a plethora of options at their disposal, each with possible risks and rewards.

A frequent mistake made by traders is over-analyzing. With so much information at their fingertips, it’s simple to become overwhelmed by the seemingly limitless array of graphs, charts, and indicators. Although analysis is crucial, becoming paralyzed by analysis can result from investing too much time examining every little aspect. Occasionally, it’s preferable to follow your intuition and make a choice based on your gut.

However, rash choices can also seriously harm a trader’s holdings. The temptation of rapid gains or the fear of losing out can impair judgment and cause impulsive trading decisions that are not supported by good strategy or reasoning. Instead of letting their emotions dictate their decisions in the heat of the moment, traders must exercise self control and adhere to their trading strategy.

In order to make profitable trading decisions, one must strike a balance between meticulous planning and methodical execution. It entails being aware of market trends and, when needed, having faith in one’s gut. Maintaining long-term profitability requires finding this fine balance, which takes practice and effort to get right.

To sum up

Anyone who is prepared to invest the required time, energy, and dedication can become proficient in trading. It’s not about being an expert in mathematics or possessing a degree in business. Trading success is the result of a persistent dedication to studying, comprehending the workings of the market, and carrying out a carefully thought-out plan. It necessitates an ongoing procedure of self-improvement, a willingness to grow from mistakes, and emotional self-control.

Join us and develop Your Trading Skills & Trade for Real When You’re Ready