This post may contain affiliate links, which means I may receive a small commission, at no cost to you, if you make a purchase through a link.

Before, bitcoin has made a “comeback.” Following a low point in 2019, prices experienced a strong recovery throughout the first year after the outbreak of the Covid-19 epidemic, but then they experienced another sharp decline in the early months of 2021. Later that year, it recovered, but with the historic FTX crisis in 2022, prices fell.

The majority of the current price increase has occurred after January 10, when the Commission on Securities and Exchanges permitted the sale of spot traded funds (ETFs), allowing well-known companies like Fidelity, Invesco, and BlackRock to consumers. And when regular investors wonder if they should include cryptocurrencies in their portfolios, some advisors are sounding a little more upbeat.

Changing Scenery

Many traditional financial advisors, portfolio managers, and financial researchers have quickly written off cryptocurrency due to its dangers and volatility. That seems to be changing, if only a little. Money managers have witnessed millions of dollars being made on Bitcoin by both professional Wall Street traders and ordinary investors, despite the fact that they do not believe that customers should follow a “diamond hands” approach mindlessly. And some do believe that a little amount of Bitcoin might fit into the typical investor’s portfolio if managed properly.

The director of portfolio research at Northern Trust Wealth Management Peter Mladina stated, “People in a market that’s competitive are selling it and they see potential in it for whatever reason, so we need to respect that.”

The suggested portfolio of Northern Trust does not include Bitcoin. Additionally, Mladina refutes some widely accepted myths regarding cryptocurrencies. He contends that it falls short of meeting all the requirements to be considered a currency and that its volatility renders it an inadequate store of value.

Although he advises against investing a significant portion of a portfolio in Bitcoin, he did say that “maybe for certain individuals there might be a small allocation.”

According to recent research, 2024 will see Bitcoin hit a new all-time high.

According to a recent report, Bitcoin (BTC) is predicted to establish a record-breaking high of $88,000 (€82,000) during the year before settling at roughly $77,000 (€71,000) at the end of 2024.

At the moment, the cryptocurrency is valued at about $43,000.

The UK fintech company Finder conducted a study on the performance of Bitcoin through 2030 based on the professional price forecasts of forty experts in the field.

The research revealed that analysts expect the typical peak price of Bitcoin to reach $87,875 in 2024, with some forecasting as high as $200,000. Conversely, they anticipate the typical lowest price of Bitcoin by the end of 2024 to be $35,734, with projections as low as $20,000.

Is today the ideal time to invest $1,000 in Bitcoin?

Think about the following before purchasing Bitcoin stock:

Bitcoin was not one of the ten stocks that the Motley Fool Stock Advisor analysis team recently named as the best ones for investors to purchase right now. In the upcoming years, the ten equities which received the cut might yield enormous profits.

Stock Advisor gives investors a clear road map for success that includes monthly stock recommendations, regular analyst updates, and advice on constructing a portfolio. Since 2002, the return on the S&P 500 has been more than tripled by the Stock Advisor service.

What might stimulate growth for Bitcoin in 2024?

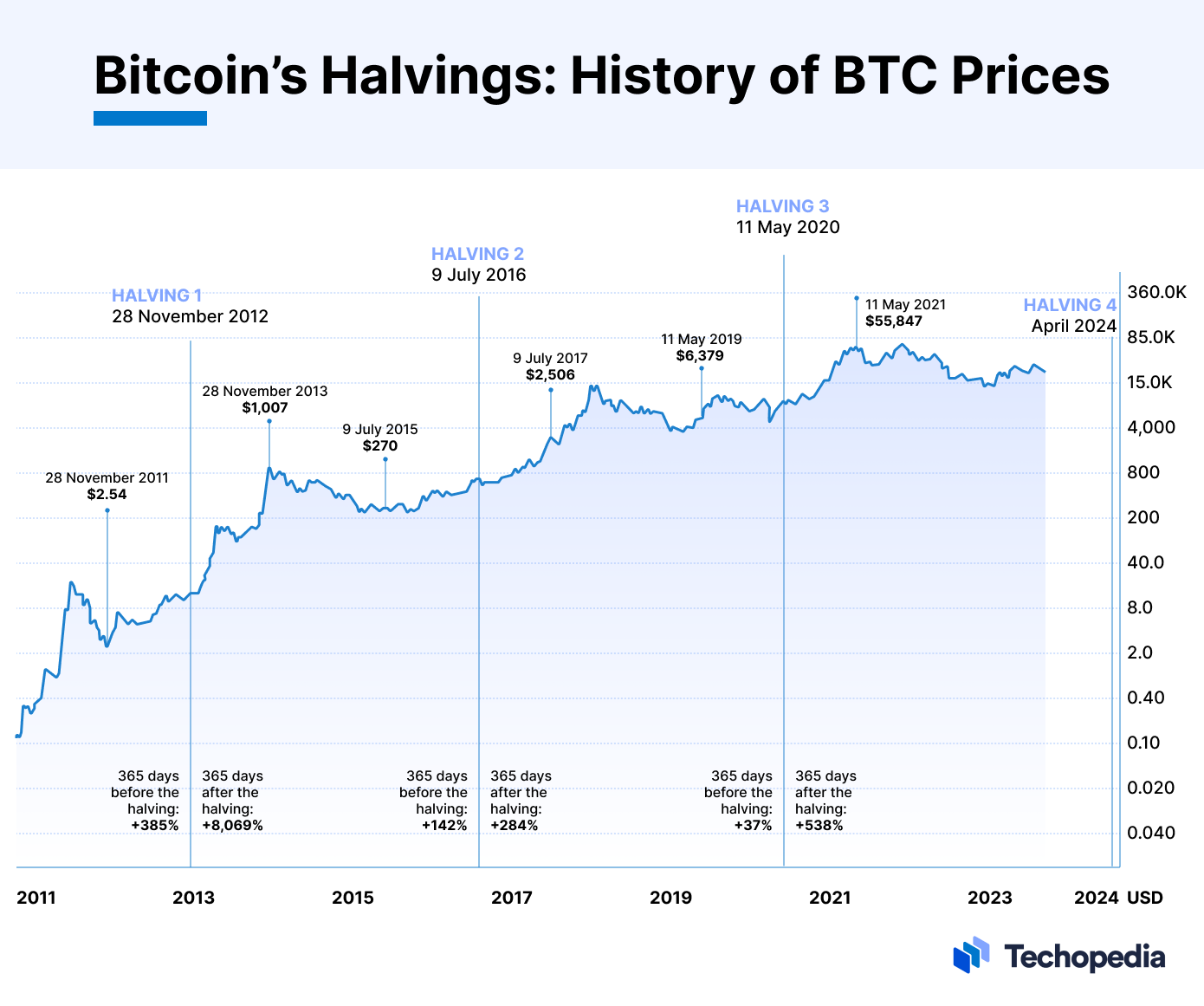

Nearly fifty percent of the specialists Finder polled predicted a price rise following a purported “BTC half event” in April 2024.

During a “halving event,” the mining reward for Bitcoin transactions reduces by 50% annually. Currently, individuals validating transactions receive 6.25 bitcoins, but this number could drop to 3.125. Halving events decrease coin’s supply, leading to price increases. Six months after the split event, approximately half of the 40 surveyed panelists (47%) anticipate Bitcoin hitting a new all-time high.

Click here to join Binance and receive a 100 USDT cashback voucher!