In this era of trading and investing in cryptocurrency, there is always constant change in the market, either the value drops or increases. It is important to have an indicator, such as the Pi Cycle Top Indicator, that can predict market trends and potential ups and downs. This way, people will know when it is the right time to invest or trade.

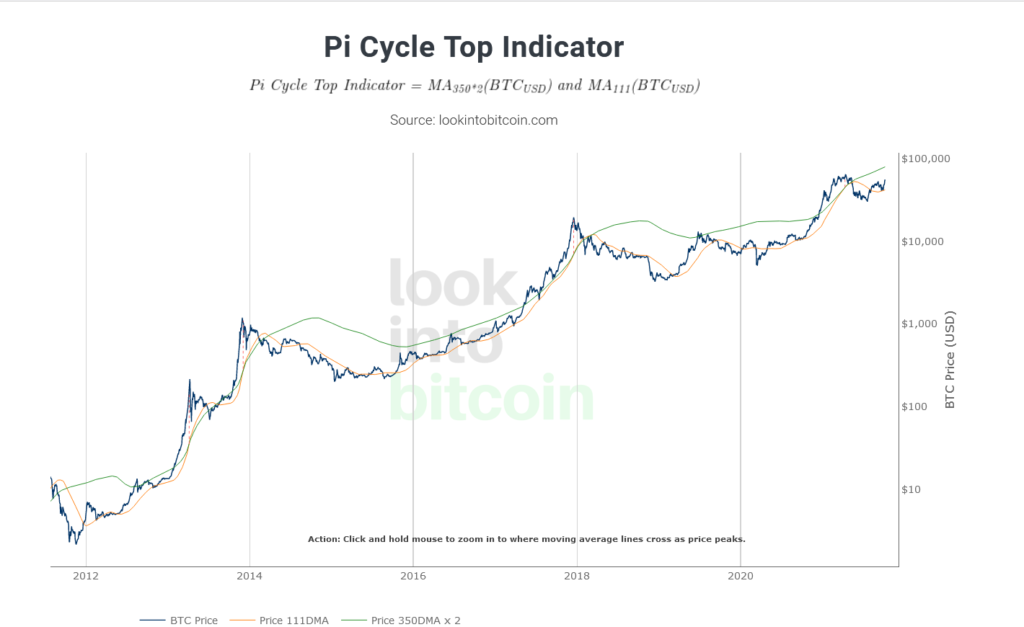

The Pi Cycle Top Indicator is a specific technical analysis tool designed to identify potential market tops in Bitcoin’s price cycles. It was developed by Philip Swift and relies on the comparison of two moving averages:111-day and 350-day moving averages. The name “Pi Cycle Top Indicator” comes from the fact that dividing 350 by 111 is roughly equal to the mathematical constant pi (π ≈ 3.14).

Uses of Pi Cycle Top Indicator

Picycle Top is useful for identifying when the market is very overheated. This means a period in the financial market where prices shoot up without control. This indicator is used to predict the peak of the Bitcoin market cycle which is helpful in trading.

How the Pi Cycle Top Indicator Works

The core principle of the indicator lies in the relationship between these two moving averages. The 111-day moving average (111DMA) and a multiple of the 350-day moving average (350 DMA x 2). When the 111 DMA crosses above the 350 DMA x 2, it signals that the market is extremely overheated, suggesting that it may be good to sell Bitcoin at this time in its price cycles. This crossover point is believed to indicate that the market has become overheated, with the shorter-term price pushing significantly above the long-term average. To calculate the Pi Cycle Top Indicator, we use this formula.

Limitations of Pi Cycle Top Indicator

As good as Pi cycle top indicator is in prediction of the market value, there are also some limitations that restrict it from being perfect. Some of the limitations are:

● The indicator has not always accurately predicted the market peak, it sends false signals when the prediction is made whereas the market price probably dropped.

● The moving averages which the indicator bases its prediction on lagging indicators meaning they react to past price movements. The crossover might not occur until after the peak has already passed.

Conclusion

By using the Pi Cycle Top Indicator strategically and staying informed about the broader market context, you can enhance your ability to navigate the ever-changing world of cryptocurrency. Remember, successful trading involves a blend of technical analysis, market knowledge, and a healthy dose of caution. So, while the Pi Cycle Top Indicator can be a helpful tool, always prioritize your own research and risk management before making any trades.

References

How Long Will the Bitcoin..

What is the Pi Cycle Top Indicator