In the rapidly evolving world of finance, robo-advisors have emerged as a transformative force in investment management. These automated platforms use algorithms to provide financial advice and manage investment portfolios with minimal human intervention. This article explores the rise of robo-advisors, highlighting their benefits, challenges, and real-world applications.

Benefits Of Robo-Advisors

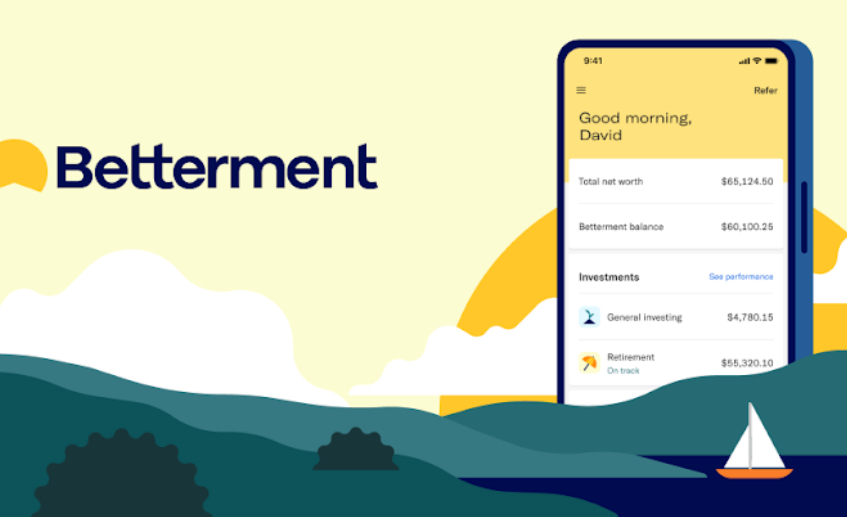

Robo-advisors offer several advantages over traditional investment management. Firstly, they provide cost-effective solutions by eliminating the need for human advisors. For example, Betterment and Wealthfront charge significantly lower fees than traditional financial advisors, making investment management more accessible. Additionally, robo-advisors offer 24/7 accessibility, allowing investors to manage their portfolios anytime, anywhere.

Furthermore, robo-advisors use progressed algorithms to fit investment strategies to individual risk resistances and financial objectives. By leveraging big data and machine learning, these platforms can analyze vast amounts of market information quickly, ensuring optimal portfolio adjustments. This level of personalization and efficiency is difficult for human advisors to match.

Moreover, the ease of use associated with robo-advisors cannot be overstated. The user-friendly interfaces of platforms like Betterment and Wealthfront enable even novice investors to navigate the complexities of investment management. This democratizes access to financial planning, empowering more people to take control of their financial futures.

Challenges Of Robo-Advisors

Despite their benefits, robo-advisors also face challenges. One major concern is the lack of personalized advice. While algorithms can provide general guidance, they may not account for individual circumstances like a human advisor can. For instance, a robo-advisor might not fully understand the nuances of a client’s financial situation, such as specific tax considerations or unique retirement planning needs.

Furthermore, there are security risks associated with digital platforms. In 2019, Wealthfront experienced a data breach, raising concerns about the safety of users’ personal information. As robo-advisors rely heavily on technology, they are vulnerable to cyber-attacks, which can compromise sensitive financial data. Ensuring robust security measures is crucial to maintain user trust and safeguard assets.

Additionally, some investors might feel uncomfortable relying solely on algorithms for their financial decisions. The lack of a human touch can be a significant drawback, especially in volatile markets where personalized reassurance and strategic adjustments are valued. The emotional support provided by human advisors during market downturns is something robo-advisors cannot replicate.

Real-World Applications

Real-world examples illustrate the impact of robo-advisors on investment management. Vanguard’s Personal Advisor Services combines human advisors with robo-advisor technology, offering a hybrid model that provides both cost-efficiency and personalized advice. This approach leverages the strengths of both automated and human advisory services, catering to a broader range of investor needs.

Another example is Charles Schwab’s Intelligent Portfolios, which automatically rebalances portfolios and offers tax-loss harvesting, demonstrating the practical benefits of automated investment management. This service highlights how robo-advisors can handle complex tasks efficiently, providing significant value to investors.

Wealthfront’s Path tool is another noteworthy example. Path offers comprehensive financial planning by analyzing user data to project future financial scenarios, helping clients set and achieve their financial goals. This level of detailed, data-driven advice underscores the potential of robo-advisors to enhance financial planning through automation.

The Future Of Robo-Advisors

The future of robo-advisors looks promising, with continuous advancements in technology poised to enhance their capabilities. Integration of artificial intelligence (AI) and machine learning is expected to make robo-advisors even more sophisticated, offering deeper insights and more nuanced financial advice. As these technologies evolve, robo-advisors will likely become more adept at handling complex financial situations, further narrowing the gap between automated and human advisory services.

Moreover, as the industry grows, we can expect increased regulation and oversight. This will help address some of the current challenges, such as security risks and the need for better personalization. Enhanced regulatory frameworks will ensure that robo-advisors adhere to high standards of transparency and security, fostering greater trust among users.

Conclusion

In conclusion, robo-advisors represent a significant innovation in the financial industry, offering cost-effective, accessible, and efficient investment management solutions. However, they also present challenges that need to be addressed, such as the lack of personalized advice and security concerns. By understanding these factors, investors can better navigate the evolving landscape of automated investment management.

The continuous evolution of technology and regulatory improvements will likely enhance the functionality and reliability of robo-advisors, making them an integral part of the financial advisory ecosystem. As such, both investors and financial institutions must stay informed about these developments to maximize the benefits of this innovative approach to investment management.

Sources:

What Is A Robo-Advisor? How Do They Work? – Forbes Advisor

How a robo-advisor works and benefits investors | Vanguard

Betterment: A robo-advisor platform for investors (cointelegraph.com)

Wealthfront Review: A Clear Robo-Advisor Champ (fool.com)

Robo-Advisor – Automated Investing Services | Vanguard

Automated Investing | Schwab Intelligent Portfolios | Charles Schwab