About Samsung

Samsung Electronics, founded in 1938 by Lee Byung-chul as a humble trading company, has grown into a global technology powerhouse.

From its early beginnings, Samsung has expanded its footprint across various industries, particularly excelling in electronics, semiconductors, and telecommunications.

Today, Samsung is synonymous with innovation, producing cutting-edge smartphones, televisions, home appliances, and more.

This blog delves into Samsung’s journey, its current stock performance, industry dominance, financial health, growth prospects, and the challenges it faces.

Current Stock Performance and Market Perception

As of 2024, Samsung Electronics (KRX: 005930.KS) continues to demonstrate resilience on the Korea Exchange.

Despite global economic fluctuations, the stock has maintained a robust performance, reflecting the company’s consistent revenue growth and profitability.

Samsung’s strong presence in the semiconductor industry and its well-established brand in consumer electronics keep market perceptions positive.

(The performance of Samsung’s stock over the last 52 weeks, including the lowest and highest prices reached during this period.)

Industry Overview and Samsung’s Strategic Advantage

- Smartphone Market

The technology and electronics industry is among the most dynamic sectors worldwide, with consumer electronics evolving rapidly. Within this space, large corporations like Samsung and Apple dominate by offering diverse product ranges that meet varied consumer needs.

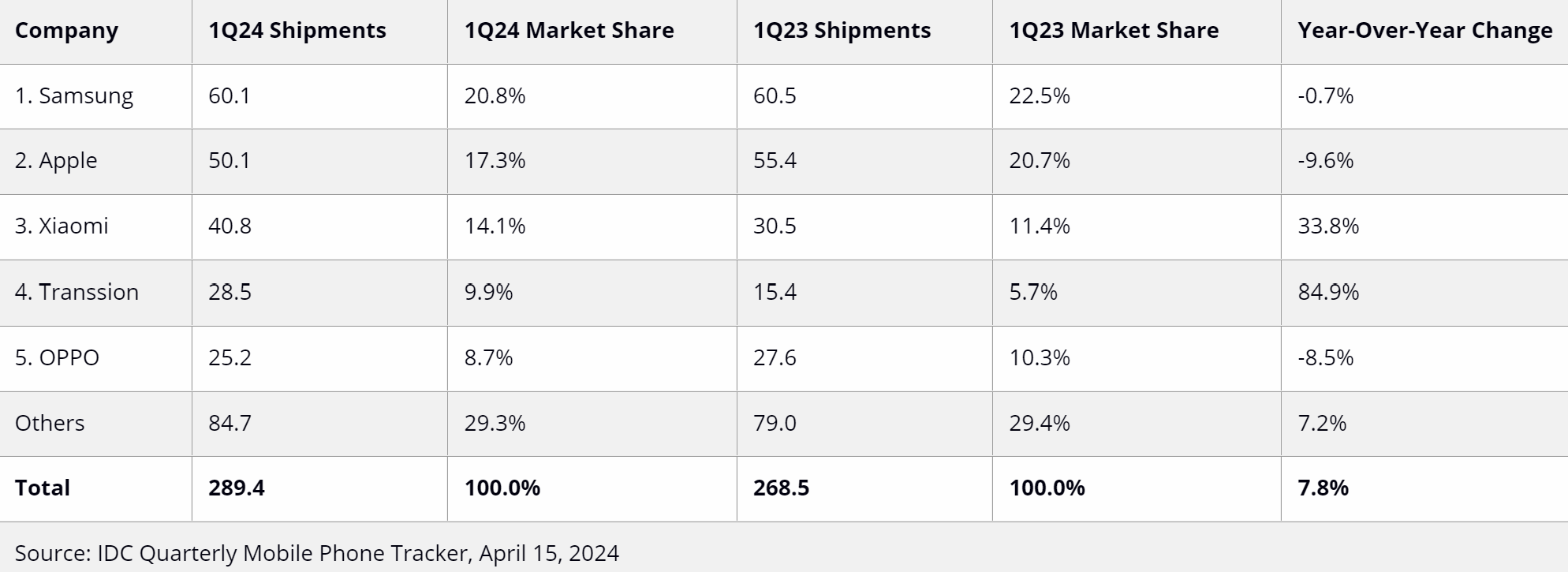

Samsung, in particular, has cemented its leadership in the smartphone market, holding a commanding 20.8% market share as of the first quarter of 2024.

While some competitors have faced negative growth, Samsung has emerged stronger, showcasing its ability to adapt and thrive.

- Semiconductor Market

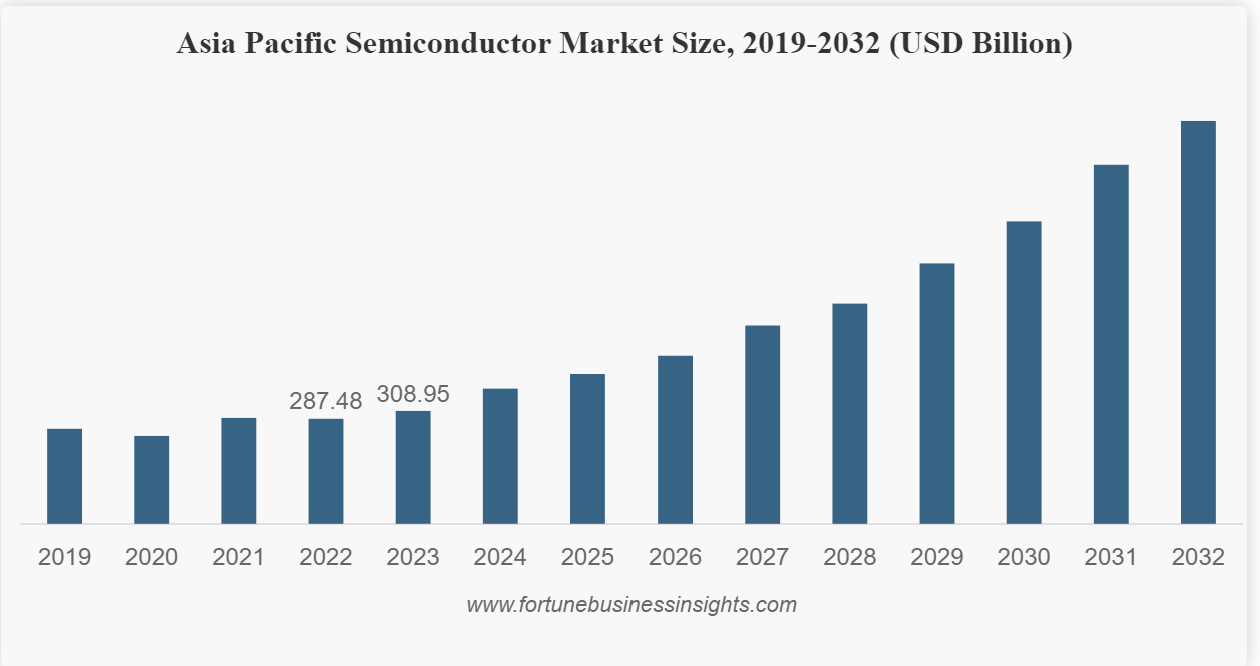

The semiconductor market has witnessed significant growth, driven by the rising demand for advanced consumer goods.

Integrated circuits (ICs) are now essential components in numerous electronic devices, from smartphones to home appliances. Samsung has responded to this demand with substantial investments in research and development.

In March 2023, Samsung announced a $230 billion investment plan to build the world’s largest semiconductor manufacturing base near Seoul, a move that underscores its commitment to leading the semiconductor industry.

Furthermore, the Asia Pacific Semiconductor Market Size is expected to continue its growth momentum in the coming years. In light of this information and developments, there could be significant and potentially game-changing advancements on the horizon for Samsung’s future.

Financial Analysis of Samsung

- Annual Revenue

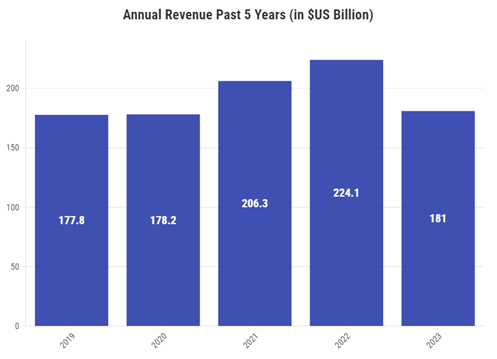

In 2023, Samsung Electronics reported a revenue of $181 billion, down from $224.1 billion in 2022. Despite this decrease, Samsung remains the largest player in its industry, significantly outpacing competitors in terms of revenue. The company’s broad product range and global market presence continue to support its leadership position.

- Revenue Benchmarks

- These data show that Samsung Electronics is the largest player in the industry and significantly outpaces other companies in terms of revenue. Samsung maintains its leadership due to its broad product range and strong presence in global markets.

- While other companies, especially those excelling in the Asian market, are strong competitors, they don’t match Samsung’s revenue scale.

(The companies listed above have been identified as similar to Samsung Electronics Co. Ltd. because they operate in related industries or sectors. Factors such as size, growth, and various financial metrics were considered to narrow down the selection.)

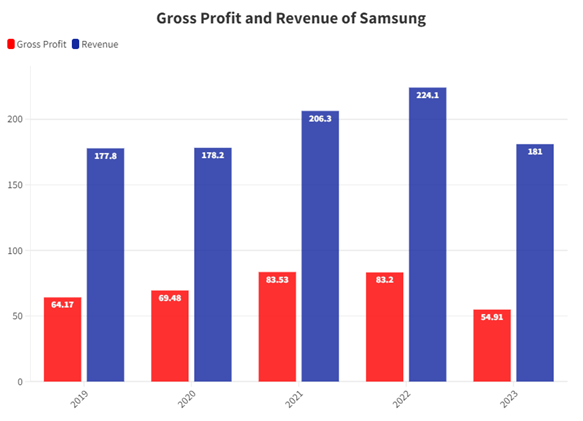

- Gross Profit

- o Samsung Electronics Co Ltd DRC Pref’s gross profit margin hit its 5-year low in December 2023 of 30.3%.

- o Samsung Electronics Co Ltd DRC Pref’s gross profit margin decreased in 2019 (36.1%, -21.0%), 2022 (37.1%, -8.3%), and 2023 (30.3%, -18.3%) and increased in 2020 (39.0%, +8.0%) and 2021 (40.5%, +3.8%).

(in $US Billion)

- Gross Profit Margin Benchmarks

- Samsung Electronics Co. Ltd stands out with its high gross profit margin compared to other companies in the industry. This indicates that the company is effectively controlling its costs and maintaining a strong market position.

- Samsung’s leadership in this area will help it sustain a competitive advantage and remain financially strong in the long term.

- Earnings per Share (EPS)

- According to Samsung‘s latest financial reports the company’s current EPS (TTM) is 3,82 €.

- In 2022 the company made an earnings per share (EPS) of 5,73 € an increase over its 2021 EPS that were of 4,53 €.

- Price-to-Earnings ratio (P/E Ratio)

- P/E Ratio indicates the multiple of earnings investors are willing to pay for one share of the company.

- Looking back at the last 5 years, Samsung Electronics’s p/e ratio peaked in December 2020 at 21.9x.

- Samsung Electronics’s P/E ratio hit its 5-year low in December 2022 of 8.9x

- P/E Ratio Benchmarks

- The average P/E ratio of companies in the sector is 14.6x with a standard deviation of 39.8x.

- Samsung Electronics Co Ltd’s P/E Ratio of 18.4x ranks in the 61.7% percentile for the sector.

- Samsung’s P/E ratio of 18.4x suggests that it is seen as a relatively strong and stable investment within its sector. The market views Samsung as a company with solid earnings and growth prospects, justifying a higher valuation compared to many of its peers.

- Dividend Yield

- The dividend yield is used to calculate the return on investment in the form of dividends that the company declared in the last year.

- Samsung Electronics Co Ltd DRC Pref’s dividend yield is 2.0%

- Dividend Yield Benchmarks

- Samsung Electronics Co Ltd DRC Pref’s Dividend Yield of 2.0% ranks in the 70.2% percentile for the sector.

Growth Prospects for Samsung Electronics

- Emerging Markets and Technological Innovation

Samsung’s future growth lies in its ability to tap into emerging markets and embrace new technologies such as artificial intelligence (AI), Internet of Things (IoT), and 5G. These areas offer Samsung opportunities to develop innovative products and further consolidate its market position. Samsung’s recent unveiling of its AI vision, coupled with advancements in semiconductor technology, highlights its forward-thinking approach.

- R&D Investments and Global Expansion

Samsung has significantly ramped up its research and development (R&D) investments, reflecting its commitment to innovation. In the first quarter of 2024, Samsung reported its highest R&D investment ever, focusing on expanding advanced processes and infrastructure within its semiconductor and display divisions.

Moreover, Samsung’s geographical expansion strategy has seen it successfully penetrate various global markets. By adapting its products to meet the unique needs of different regions, Samsung has reinforced its global dominance in the electronics industry.

Potential Risks Involved in Investing in Samsung

- Geopolitical and Publicity Risks

While Samsung continues to thrive, it faces geopolitical risks, particularly concerning tensions between South Korea and North Korea. Additionally, Samsung has been involved in patent disputes and corporate governance issues, which could impact its public image and operational stability.

- Supply Chain Issues

The global COVID-19 pandemic highlighted vulnerabilities in essential supply chains, but Samsung has taken proactive steps to mitigate these risks. Through initiatives like its co-prosperity program, Samsung has supported its suppliers with significant financial aid, ensuring long-term business continuity.

- Rising Competition and Security Issues

The smartphone market, a significant revenue source for Samsung, is becoming increasingly competitive. Chinese companies like Xiaomi have taken a substantial market share, challenging Samsung’s dominance.

Additionally, concerns over the security of Samsung’s operating systems have emerged, particularly among organizational buyers. Samsung is addressing these issues with high-tech updates to regain trust and maintain its competitive edge.

Conclusion

Samsung Electronics has established itself as a global leader in technology, with a strong presence in the smartphone and semiconductor markets.

Despite challenges like increasing competition and supply chain issues, Samsung continues to innovate and expand, leveraging its strong brand and extensive R&D investments.

As the company focuses on emerging technologies like AI, IoT, and 5G, its future prospects look promising. However, potential investors should remain mindful of the geopolitical risks and market dynamics that could impact its trajectory.

Overall, Samsung’s diversified portfolio and global reach position it well for sustained growth and market leadership in the coming years.

Reference List

- Financial Charts of Samsung Electronics

- Semiconductor Market Analysis: Asia Pacific Semiconductor Market Size

- How Samsung has Supported Its Suppliers During the COVID-19 Pandemic

- The Globe: The Paradox of Samsung’s Rise

- In the Electronics Industry, Diversification is the Key to Resilience

- Financial Analysis of Samsung with Metrics