As scary as it may seem to us, volatility and uncertainty in the market’s frequent fluctuations can also work to our advantage. Nevertheless, unique opportunities are created that can lead to profit. As we use strategy to follow a tactic, fear is reduced and traders can achieve consistent returns, even in very intense periods. In this article, we will introduce five trades that can help any trader take advantage of market volatility, turning potential risks into rewarding opportunities.

Strategy 1: Trend Following in Unstable Markets

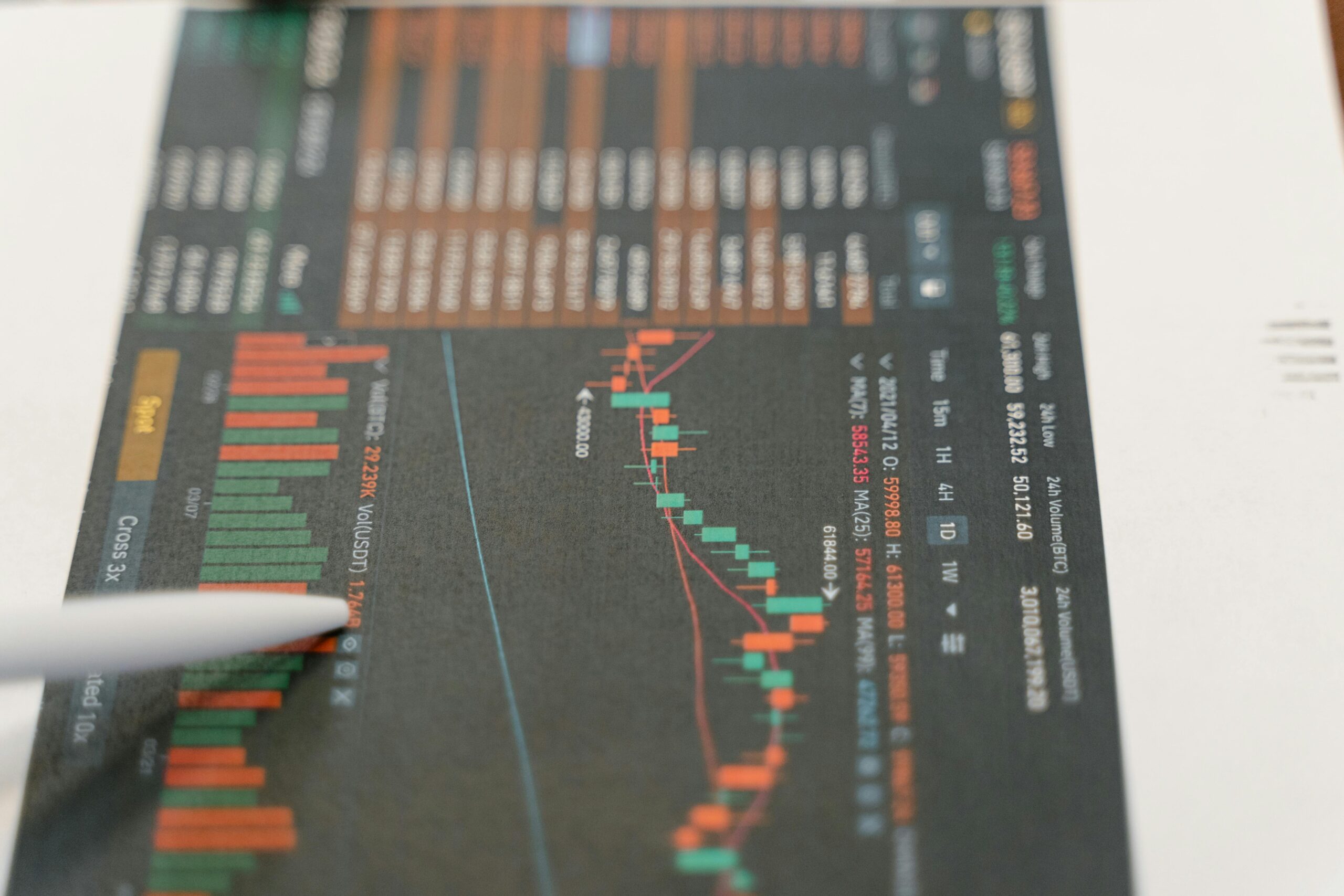

Trend following is ideal during volatile periods since it takes advantage of market momentum. In order to determine entry and exit points, traders use tools such as trendlines and moving averages to identify trends. Quick exits are required if trends reverse, flexibility is essential and stop-loss orders aid in capital protection. Profits can be further increased by employing strategies like break-out trading. Traders can convert volatility into consistent returns by maintaining discipline.

Strategy 2: Swing Trading to Maximize Short-Term Gains

Swing traders use technical analysis to find opportunities with an intermediate time frame. It may be ideal for people looking for less frequent but potentially higher earnings because it requires less time commitment than day trading. Effective risk management and well-informed decision-making through technical and occasionally fundamental studies are essential to the strategy’s success. As with any trading technique, traders must be aware of their investment, objectives and risk tolerance in

order to align them with their overall trading goals. Learn more about using advanced charting tools for better decision-making.

Strategy 3: Using Technical Indicators for Precision Entries and Exits

In volatile markets, technical indicators are crucial for making accurate decisions. Here’s how to use them to your advantage:

Moving Averages:

To smooth out price fluctuations to reveal underlying trends.

Help identify the direction of the market for better entry points.

Relative Strength Index (RSI):

Indicates overbought or oversold conditions.

Signals potential reversals, allowing for timely exits or entries.

Bollinger Bands:

These indicators of markets volatility can be used to identify possible breakouts or reversals.

As prices approach the top or lower bands, assist in identifying the best times to enter the market.

Strategy 4: Hedging as a Risk Management Tool

Another essential tactic for protecting investments in unstable markets is hedging. It involves balancing possible losses with complementary assets, such as futures and options. For instance, whereas selling future locks in prices, purchasing put options enable traders to sell at a predetermined price. This approach lowers losses and offers comfort, which results in more intelligent trading choices. It might, however, also restrict potential profits.

Strategy 5: Building a Diversified Portfolio for Long-Term Resilience

Building a diverse portfolio is essential for long-term resilience in the uncertain environment of today. Investors need to move beyond standard category diversification considering the growing uncertainty brought on by geopolitical crises, advances in technology, and climate change. On the other hand, a more detailed strategy that distributes investments across several parts and regions may provide stronger protection. Explore a variety of assets here to create a well-rounded investment strategy for the future.

For example, diversifying within the real estate industry by focusing on industries like logistics and data centers might help reduce the risks brought on by macroeconomic swings. Furthermore, especially in developing industries like climate tech, investors can take advantage of possibilities that others would pass up by utilizing long-term, flexible funding. Investors can more effectively manage uncertainty and set themselves up for consistent growth in a changing market by adhering to fundamental principles and adopting a diversified approach.

Conclusion: Combining Strategies for Success in Volatile Environments

For best results, navigating unpredictable markets calls for a comprehensive strategy that combines many trading techniques. Traders can profit from market swings and effectively manage risks by combining trend following, swing trading, and technical indicators. Building a diverse portfolio guarantees long-term resilience in the face of uncertainty, while hedging further strengthens this by acting as a safety net against possible losses. By adjusting to shifting market conditions and new trends, traders and investors can use the interaction of these tactics to transform turbulence into

opportunity. Regardless of the commotion around them, market participants can position themselves for steady returns by staying knowledgeable and disciplined.

References

Radeciety – Best Trend Following Trading Strategies

Finextra – The Art of Swing Trading to Increase Profits

Weforum – How to build a resilient investment portfolio in uncertain times