Alibaba’s (NYSE:BABA) stock is currently trading below its debut price on the U.S. stock market, despite the company having experienced a tenfold increase in business over the previous ten years. Furthermore, Alibaba continues to be a strong force in the second-largest economy in the world, demonstrating remarkable growth and efficiency across a variety of business areas, despite an awareness of political dangers and geopolitical tensions. The company’s strong balance sheet enables significant R&D expenditures, guaranteeing steady growth and strategic stability over the long run. In addition, Alibaba’s stock is a compelling ‘Strong Buy‘, with large potential benefits for investors, given its target price of $178, which implies tremendous upside potential and the company’s exceptional profitability.

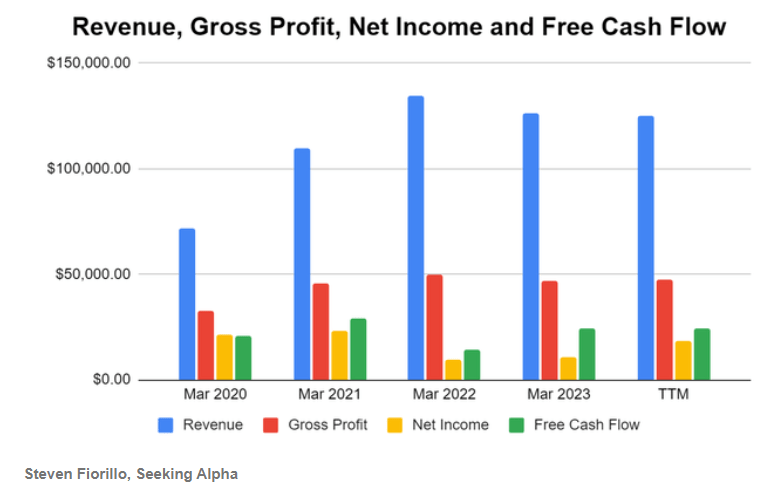

A look of BABA’s financials and business model

BABA is a complex corporation with a wide range of investments and business divisions, which makes valuation more difficult. Nonetheless, the business appears to have an excellent market position given its dominance in cloud computing and e-commerce in China, which is similar to that of Amazon in the US.

Despite this, Alibaba has encountered regulatory challenges that have affected investor confidence and the stock price, including an all-time high penalty of 18 billion yuan ($2.75 billion) over anti-monopoly offenses.

Competitive Position and Market Trends

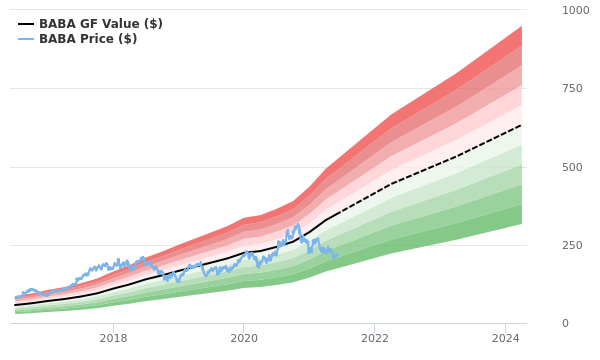

When assessing BABA’s worth, the competitive environment and market developments are crucial considerations. In addition, stock price has dropped due to its decision to abandon its cloud business spin-off and Morgan Stanley’s recent downgrade. In premarket trading, U.S. shares fell 1.5% to $73.7, which is a new one-year low (Reuters).

If the company’s fundamentals hold up, investors may find a chance in this stock price decrease. Additionally, based on LSEG projections, Alibaba’s projected Price-to-Earnings (PE) ratio was 7.62, which is lower than both its historical averages and its peers in the IT and e-commerce industries. In comparison to its profits potential, a low ratio of PE may suggest that the company’s shares are cheap.

Alibaba and Amazon Share Similarities

Is Alibaba comparable to Amazon? They are somewhat similar to one other. These online marketplaces are massive digital companies that aim to reach as many clients as they can with their products. In addition to being the top marketplaces in their respective countries, they have a similar basic business strategy of bringing together customers and sellers.

Selling Alibaba on Amazon: A Clever and Easy Tactic

What is the most reasonable question to ask while buying from Alibaba and selling on Amazon? This is because Alibaba and Amazon have different revenue-driving mechanisms and different target consumer profiles. Fortunately, it’s not as hard as it sounds. Thus, this is how to sell on Amazon using Alibaba.

Conclusion

It is reasonable to draw the conclusion that Alibaba limited’s stock looks undervalued based on the information and analysis presented. The case for undervaluation is supported by the company’s strong market positions in cloud computing and e-commerce, as well as by favorable analyst price forecasts and a low future PE ratio. Nonetheless, investors need to take into account the potential impact of market volatility and regulatory uncertainties on Alibaba’s future performance. Even while the stock might be cheap, it is still important for investors to do their research and take into account the larger regulatory and economic landscape where BABA operates. Satisfying these obstacles and sustaining the pace of its development will be essential for the company to realize the potential increase in its valuation.

When it comes to managing an online retail firm, Alibaba and Amazon both seem promising. The most creative tactic is to purchase goods on Alibaba and then resell them on Amazon. To be honest, this is how the majority of Amazon sellers operate, with the exception of those who independently make their goods. Because Alibaba and Amazon are fairly competitive, you might want to think about starting as soon as possible.