This post may contain affiliate links, which means I may receive a small commission, at no cost to you, if you make a purchase through a link.

CEO of Meta Platforms (META), Mark Zuckerberg, has sold shares in the company for more than $228 million since November 2023 began. Although the financial media has given extensive emphasis to the action, should long-term shareholders be concerned about Zuckerberg’s recent selling of META stock?

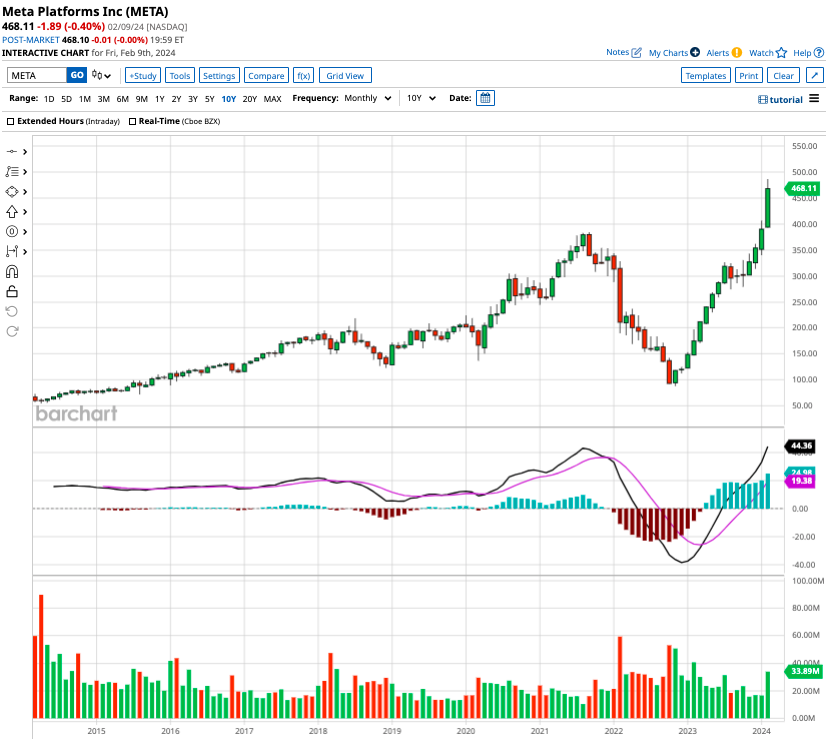

Typically, when insiders of the firm purchase shares, it indicates that they believe the stock is cheap and have high expectations for the company’s future. Investors may naturally become concerned when a prominent member of the leadership team cuts their investment, especially considering the unusual 166% YTD return on META stock.

Does Zuckerberg believe that the social media behemoth is now overpriced?

Several of Zuckerberg’s other tech billionaires have recently contributed or sold millions of dollars through stock transactions, including Jeff Bezos, the founder of Amazon, Jen Huang, the CEO of Nvidia, and Marc Benioff, the head of Salesforce. Notably, following a terrible year for technology companies in 2022, this is Zuckerberg’s first stock sell since 2021. The majority of the CEO’s holdings in META are held through non-public preferred voting shares. Thus, it’s critical to take the wider picture into account.

The reasons META stock is not yet overpriced

Meta Platforms’ price-to-earnings ratio was in the low teens by the end of 2022. This placed the shares firmly in the value stock category. META is no longer available at such a low price, but it is also not inflated. In other words, it is no longer undervalued. One explanation for this is that, in comparison to the “Magnificent Seven” stocks, META shares are trading at the bottom of the valuation range. If you are interested in buying META stock , make sure to use eToro!

The “Magnificent Seven,” as you may be aware, comprise the seven technology companies that significantly influence how the overall market moves.

Estimate of fair value for Meta

Data as of Feb 5, 2024 Source: Morningstar Direct.

We rate Meta’s stock as overpriced compared to our long-term fair value assessment, resulting in a 2-star rating.

Our estimate involves multiplying the enterprise value by the projected adjusted EBITDA for 2024. Meta’s income growth relies on online advertising, allocating an increasing share to adaptable, video, and social media ads. We anticipate a robust 16% growth in ad income for 2024, followed by a 9% increase in 2025, assuming sustained economic development and additional monetization of Reels. A 2% annual growth in Meta’s monthly active users is projected, primarily influenced by the “rest of the world” and Asia regions.

Is it the appropriate time for you to invest $1,000 in Meta Platforms?

Think about this before purchasing Meta Platforms stock:

The Motley Fool Stock Advisor analyst team has determined the top ten stocks that investors should purchase right now. and among them was not Meta Platforms. In the upcoming years, the ten equities which received the cut might yield enormous profits.

Think back to April 15, 2005, when Nvidia created this list. At that time, $1,000 would have bought you $522,227 if you had invested!

Stock Advisor gives investors a clear road map for success that includes monthly stock recommendations, regular analyst updates, and advice on constructing a portfolio. Since 2002, the S&P 500 return has more than doubled thanks to the Stock Advisor service.

Click here to Sign up to Revolut where you can invest in stocks and crypto and exchange currencies with low fees.